18 Which of the Following Best Describes Term Life Insurance

72 of Americans answered this question correctly. The insured can borrow or collect the cash value of the policy.

Body Type Quiz Are You An Endomorph Ectomorph Or Mesomorph Everyday Health

An insured has a variable life policy with a 100000 face amount.

. And if the accident insurance event occurs the insurance company will bear all or all of the costs in full or in part. Dying before financial obligations have been met. The insured pays the premium until his or her death.

And if the accident insurance event occurs the insurance company will bear all or all of the costs in full or in part. Benefits are doubled under certain circumstances stated in the policy b. The beneficiary must have insurable interest in the insured.

What is NOT true about beneficiary designations. 2 days agoA type of life insurance that guarantees payment of a stated death benefit if the covered person dies during a specified term. Which of the following best describes term life insurance.

The insured is covered during his or her entire lifetime. A a 3-year renewable policy allows a term policyowner to renew the same coverage for another 3 years. Depending on the chosen program you can partially or completely protect yourself from unforeseen expenses.

The insured is covered during his or her entire lifetime. A source of emergency cash for any financial need. The insured pays the premium until his or her death.

Term insurance is paid over a short period of time such as 1 time a year for a short period of. The insured is covered during his or her. A Universal Life Insurance policy is best described as.

Which of the following best describes annually renewable term insurance. Common terms for term life are 10 15 20 or. The insured pays a premium for a specified number of years.

Starting a family getting married starting a business or switching to a profession where danger is involved are all great reasons to take out a policy. Centre of influence E. Which of the following best describes term life insurance.

The insured can borrow or collect the cash value of the policy. It is level term insurance. An insureds cancelable health insurance policy is being cancelled.

Term life insurance covers you during the most important years of your life The best time to open a term life insurance policy is when youre expecting to make a big life decision. B a 3-year renewable policy allows a term policyowner to increase coverage for the next 3 years. Best Life Insurance Companies.

Term life insurance covers you during the most important years of your life The best time to open a term life insurance policy is when youre expecting to make a big life decision. Term life insurance is well suited for all the following needs EXCEPT. Which of the following best describes term life insurance.

C an option to convert provides that a term life insurance policy can be exchanged for a. Life insurance can be Term or Whole Life. Depending on the chosen program you can partially or completely protect yourself from unforeseen expenses.

Which of the following best describes the coverage that he would receive. It requires proof of insurability at each renewal. Whole life is a form of permanent life.

All of the following statements regarding term life insurance are correct EXCEPT. Suppose that under your health insurance policy hospital expenses are subject to a 1000 deductible and. This is one of the common selling points for whole life or universal life rather than term life insurance.

A Neither the premium nor the death benefit is affected by the insureds age. B It provides an annually increasing death benefit. All of the following best describes Term Life Insurance EXCEPT.

What term best describes the role the veterinarians play in this scenario. C It is level term insurance. Probability of dying increasing as you grow older.

The insured pays the premium until his or her death. In cases where there are a large number of prospects for a product dispersed over a large geographical area a salesperson should consider using which of the following approaches. Which of the following best describes term life insurance.

Added 1 minute 42 seconds ago4242022 51855 AM. Two of the oldest varieties of life insuranceterm and whole liferemain among the most popular types. Written for a specified time period.

The insured pays a premium for a specified number of years. If the claim is disputed in court and the insurer loses the face amount will. Which of the following BEST describes a double indemnity provision in travel accident insurance.

Log in for more information. Term life insurance may last from 1-30 years. Neither the premium nor the death benefit is affected by the insureds age.

Because it only offers protection for a limited time term life is best used for temporary needs that have a defined end-date. In the following year the cash value took a significant decline and was worth only 70000. Like other types of life insurance endowment contracts pay a death benefit at the insureds death.

Which of the following best describes annually renewable term insurance. Which of the following best describes term life insurance is a tool to reduce your risks. During this time the policy face amount was increased to 150000.

21- Which of the following best describes what life insurance is designed to protect against. It provides an annually increasing death benefit. Is a tool to reduce your risks.

See the answer See the answer done loading. One day before the policy is scheduled to end he is involved in a major accident and is hospitalized fora week. Life term insurance is temporary life insurance that lasts for a specific period of time.

-best describes term life insurance. An Annually Renewable Term policy with a cash value account. Which of the following best describes the difference between PURE LIFE and LIFE WITH GUARANTEED MINIMUM settlement.

At one time the cash value exceeded 100000 and was worth 150000.

Bay Area Council Bayareacouncil Twitter

Treatment Of Childhood And Adolescent Depression American Family Physician

Survival Of The Fittest Definition Applications Examples Britannica

The Ultimate Guide To Concept Testing Surveymonkey

Covid 19 How Are Countries Preparing To Mitigate The Learning Loss As Schools Reopen Trends And Emerging Good Practices To Support The Most Vulnerable Children

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

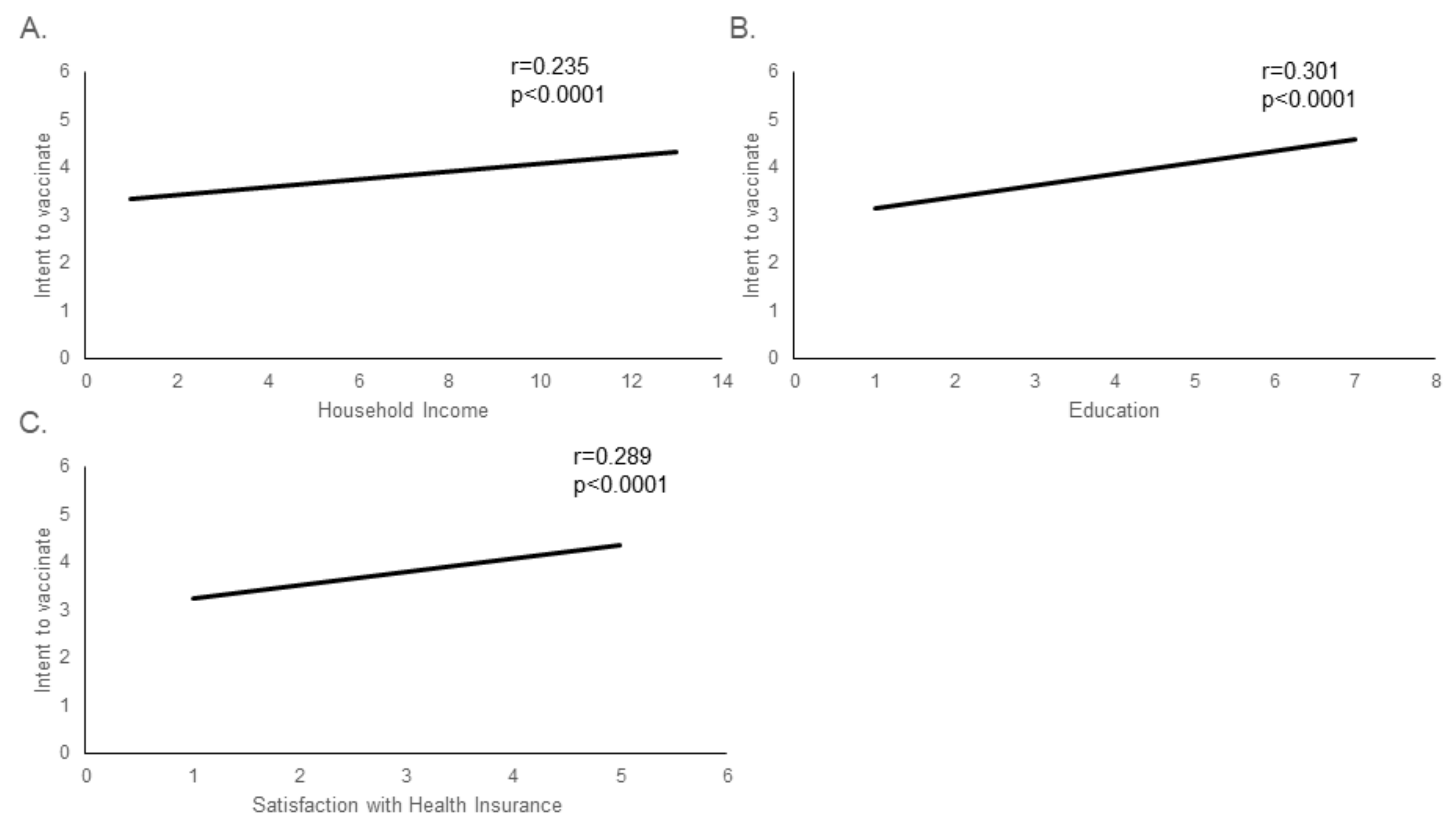

Vaccines Free Full Text Influences On Attitudes Regarding Potential Covid 19 Vaccination In The United States Html

Clear Liquid Diet Description How To Follow And Using For Colonoscopy Diverticulitis

Washington Commanders Name Unpopular Among D C Residents The Washington Post

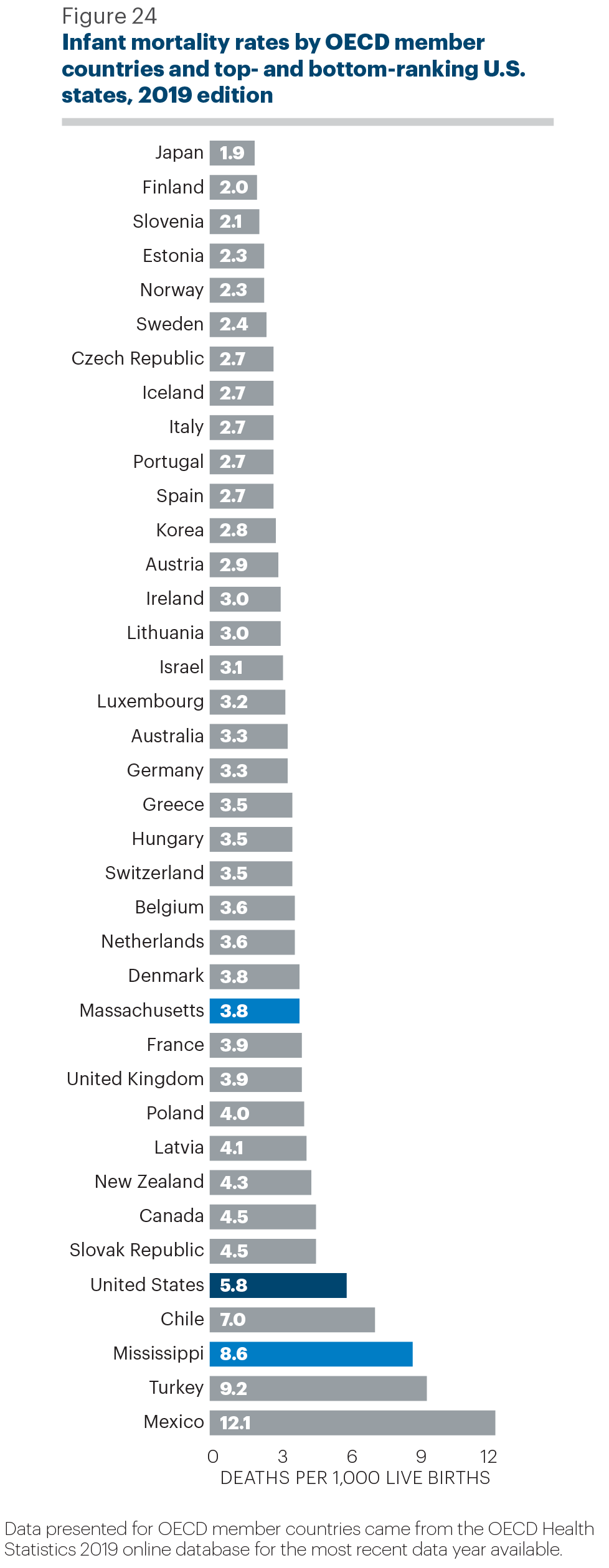

International Comparison 2019 Annual Report Ahr

/modular-vs-manufactured-home-insurance-5074202_final-fdb217e866f84bdda6418d6c68e4c267.png)

Understanding Facultative Vs Treaty Reinsurance

International Comparison 2019 Annual Report Ahr

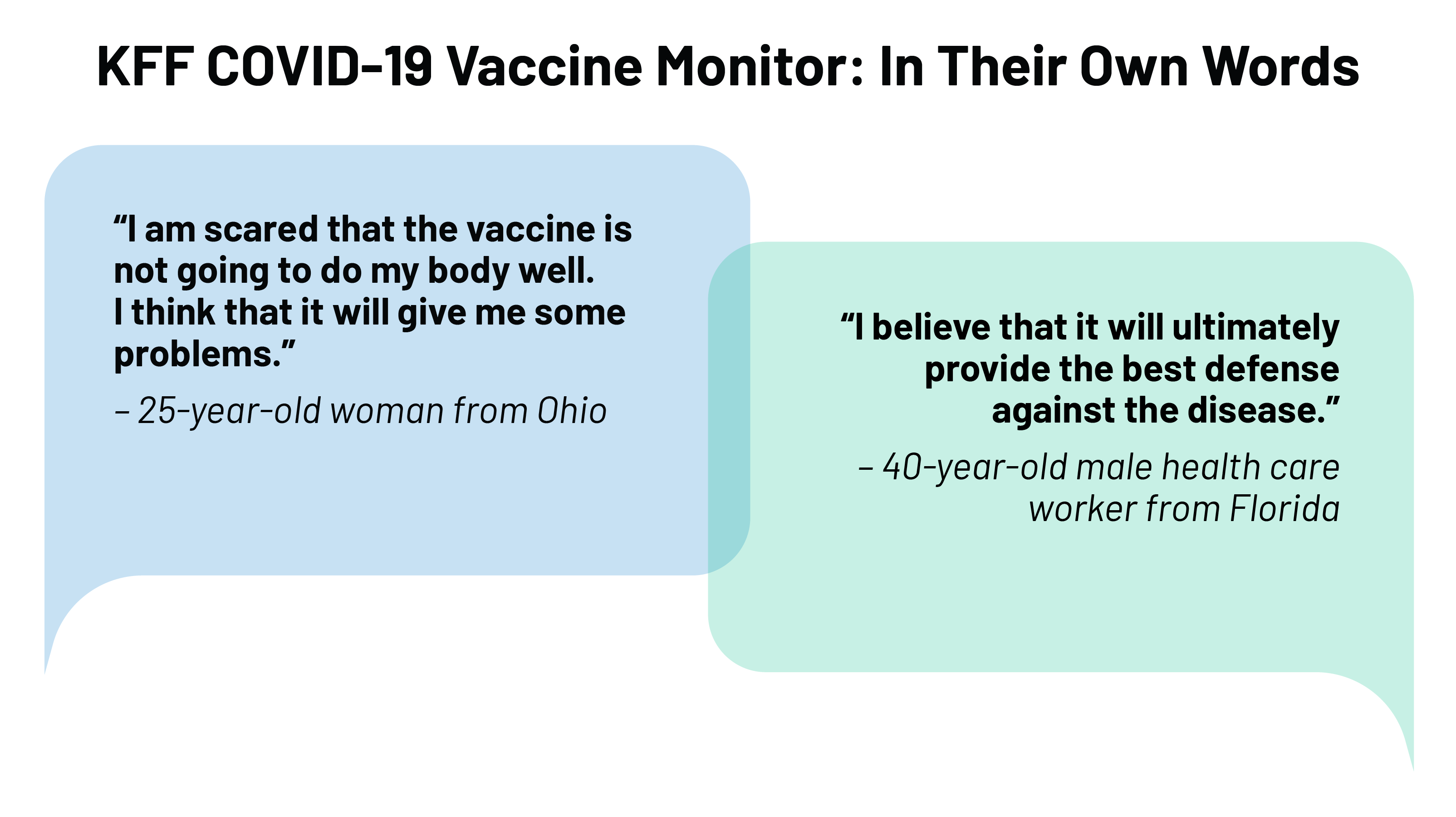

Kff Covid 19 Vaccine Monitor In Their Own Words Six Months Later Kff

85 Poll Questions For Every Occasion Mentimeter

How To Write Compelling Meta Descriptions For Seo 2021

International Comparison 2019 Annual Report Ahr

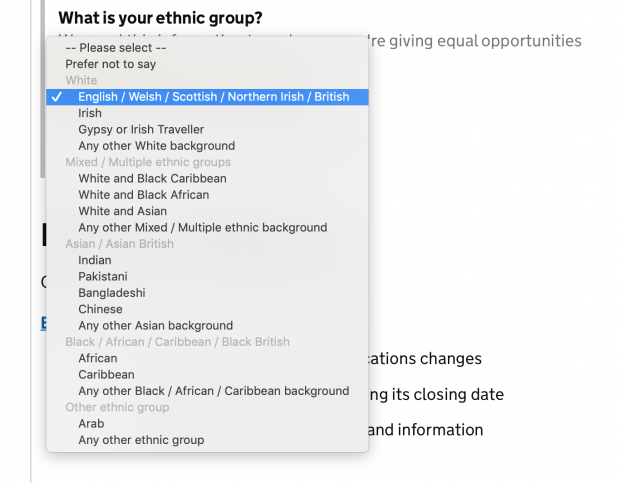

Researching How We Ask Users About Their Ethnicity Design In Government

:max_bytes(150000):strip_icc()/dotdash_INV_final_Gapping_Jan_2021-02-3cdbe5db7472465b8fe5dca9797772bd.jpg)

Comments

Post a Comment